Do you ever feel like there are times in your business that you keep bumping up against an invisible force field? Something that holds you back regardless of how hard you try to grow or move forward? What you may be experiencing is something James Fischer, in his book Navigating the Growth Curve, calls Hidden Agents or growth Transition Zones. Hidden Agents are obstacles to growth that were not easy for a leader to identify. Additionally, as companies move from stage-to-stage, they experience Transition Zones that complicate growth and can create business chaos.

In this blog, we will continue to reveal insights and wisdom from the book “Navigating the Growth Curve” that help leaders understand and manage the increasing complexity at every level of business growth. These materials were reviewed, discussed, learned and made actionable in the February 2020 Executive Forums Silicon Valley mastermind sessions.

Hidden Agents

Sometimes on the surface, issues look unclear and may only really show symptoms or side effects which can make it difficult to identify the real cause and design and implement the correct solutions. The three hidden agents identified by Fisher are shown in the graphic below and are obstacles to growth, hidden below the surface and difficult to diagnose.

27 Classic Challenges

One of the hidden agents identified in James Fischer’s research are the 27 Classic Challenges that companies face at one time or the other. Many times, several of these Classic Challenges were critical for business to address at a specific point in time – related to the company’s current stage of growth. The successful companies took the time and energy to focus on a critical few at any one time. They addressed the most critical challenge for their stage of growth and moved on. Take a look at the graphic below and identify your company’s stage and assess the challenges you might want to address. The key is for the leader and team is to stay focused on the right things at the right time.

Builder Protector Ratio

A second hidden agent identified in James Fischer’s research is the builder protector ratio. The B/P Ratio can be explained by understanding that in every company there are Builders (risk takers) and there are Protectors (risk averse). The Builder/Protector aspect of the Stages of Growth is a measurement within a company of confidence vs. caution.

- Builders (risk takers) create new ideas and take new initiatives, find ways to expand revenue and profits, challenge the way things are done, and are highly confident.

- Protectors (risk averse) are cautious and slow-paced, seek stability, may not feel confident in company’s financial strength, and tend to be suspicious of new markets.

As navigating the growth curve materials are about growth companies, you can see in the graphic below that the ratio of Builders to Protectors is greater than one for all of the stages except for the Delegation – Stage 3. Are you hiring enough Builders to achieve the right ratio at your stage of growth?

Three Faces of a Leader

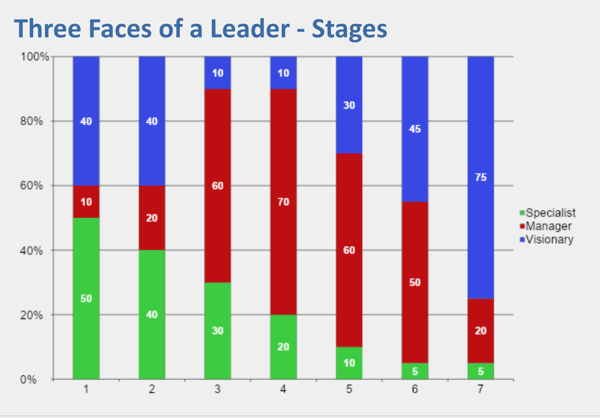

The third hidden agent is called the Three Faces of a Leader Blend and is reflective of the leader within an organization. Depending on a company’s stage of growth, the leader must deliver a different blend (mix) of leadership attributes to make the company successful and keep the company growing. The three leadership attributes that must be blended in each stage are being a Visionary, a Manager and a Specialist.

- Visionary Leader - makes sure the company knows where it wants to go.

- Manager Leader – grows company through managing the work and the people.

- Specialist Leader - delivers work to make sure the product meets clients’ needs.

As seen in the graphic below, the Visionary Leader is extremely important in a company’s early and late stages while the Manager Leader is dominated in a company’s middle stages. Note that the Specialist Leader decreases continually as a company grows.

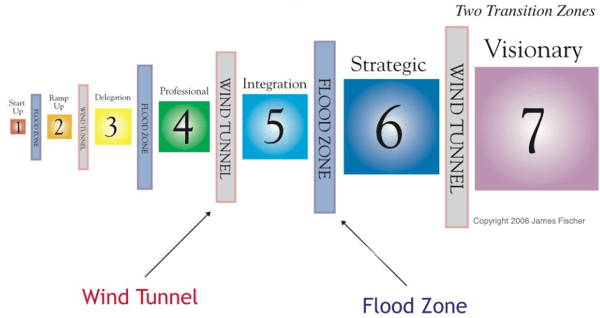

Transition Zones

Finally, let’s look at what happens as a company transitions from one stage to another. A Transition Zone is a phase of chaos that the organization goes through to prepare for the next Stage of Growth. Rarely does it go smoothly, however, it does always go predictably. You can expect confusion and some chaos with your staff as you work through these zones, but if you aren’t prepared for them, they can take a toll on you and your leadership team.

Transitions between stages occur as either predictably as Flood Zones or Wind Tunnel. A Transition Zone is a phase of chaos that the organization goes through to prepare for the next Stage of Growth. Without this chaos, the organization would not be able to sustain itself or be able to compete in the next Stage of Growth. These zones can sometimes be identified by the mumbled complaints at leadership for putting the company in this ‘mess’. In truth most often the chaos couldn’t have been avoided and was a natural result of the company preparing for its next Stage of Growth.

- Flood Transition Zone - a transition where the organization experiences a FLOOD of activity. It is being overwhelmed. The feeling inside a company is that you don’t have enough people to handle all the work. You feel like you can barely keep your head above water.

To address the chaos during a flood transition zone, you must

-

- Communicate to people the upcoming increase in workload

- Avoid the temptation to add new staff (hire at last resort)

- Focus on the WAY your company manages workload

- Wind Tunnel Transition Zone - is defined by a condition where the company needs to let go of ideas and processes that no longer work and create new ones that do. Often times the leadership of a company will have a difficult time realizing that what worked in the past is not going to work any longer.

To address the chaos during a wind tunnel transition zone, you must

-

- Communicate growth and processes must change

- Evaluate (measure) which processes must change

- Don’t blame people for issues that require new processes

- Consider the use and implementation of technology

As you can see in the graphic below, the Flood Transition Zone occurs leaving Stages 1, 3 while the Wind Tunnel Transition Zone occurs leaving Stages 2, 4 and 6.

The Stages of Growth material is very rich and challenged each leader in the Executive Forums Silicon Valley community to think deeply about the current state of their business and how to shore up the foundations for future growth. Having the knowledge to predict what is coming next and be able to align leadership and company focus to address these challenges can keep growth on track. We have discussed in pars 1 and Part 2 of this blog the following concepts.

- Stages of Growth – the number of people drive complexity and growth stage

- Gates of Focus – profit, process, people – where to focus and when

- Four Key Messages – if you are not growing, you are dying

- Hidden Agents – Classic Challenges, Builder Protector, 3 Faces of a Leader

- Transition Zones – how to address the Flood or Wind Tunnel transitions

Part 3 of this blog, we will discuss the “Building Blocks of infrastructure, Culture and Leadership” and how to “Rewild” your business to get it back onto a high growth trajectory.

Here is the link to Part 1 of this Blog - 7 Stages of Growth and the 3 Gates of Focus.

================================================================

At EFSV, selected business owners and leaders work together to gain clarity, insight and accountability to ignite their leadership engines, grow their businesses and improve their lives. If you are interested in learning more about the Stages of Growth or becoming a member at Executive Forum Silicon Valley, please contact gperkins@executiveforums.com or call 408-901-0321. For more information visit https://execforumssv.com/