It’s a competitive jungle out there, and the most sought-after prizes aren’t treasure chests of money, but people. High performing employees to be specific. Regardless of employment levels, top companies know that success depends on not only attracting and retaining your most productive employees, but also on building a healthy set of employee performance metrics. This article will focus on four employee metrics that are not usually tracked, though they can make or break your business value. These key employee metrics are:

- Employees per square foot

- Customers per account manager

- Ratio of Promoters to Detractors

- Revenue per employee

If you’re planning to sell your company one day, tracking key ratios is a must. Acquirers like tracking ratios, and the more relevant ratios you can provide a potential buyer, the more comfortable they will become with the idea of buying your business. The bulk of the employee ratios that successful businesses need to monitor involve how human capital is most effectively used in a given enterprise.

Numerous sources can be found to confirm the following: “There is no doubt about the fact that the human asset is the key intangible asset for any organization. In today’s dynamic and continuously changing business world, it is the human assets and not the fixed or tangible assets that differentiate an organization from its competitors.”

There are four key employee metrics to keep your eye on, the first two having to do with efficiency and the last two focused on effectiveness.

- Employees per square foot

By calculating the number of square feet of office space you rent and dividing it by the number of employees you have, you can judge how efficiently you have designed your space. Commercial real estate agents use a general rule of 175-250 square feet of usable space per employee. It’s not about crowding more employees into less space, it’s about workflow and productivity, so take virtual teams and work-from-home options into your calculations too.

- Customers per Account Manager

How many customers do you ask your account managers to manage? Finding a balance can be tricky. Some bankers are forced to juggle more than 400 accounts, and therefore do not know each of their customers, whereas some high-end wealth managers may have just 50 clients to stay in contact with. It’s hard to say what the right ratio is because it is so highly dependent on your industry. Slowly increase your ratio of customers per account manager until you see the first signs of deterioration (slowing sales, drop in customer satisfaction). That’s when you know you have pushed it too far. You’re trying to create a balanced, high-performing team, where account managers can effectively spread their expertise over a full plate of customers, removing some of the waste in workflow management so that managers have their time well spent and customer needs are being met by an experienced resource.

- Ratio of Promoters and Detractors

The Net Promoter Score® methodology, developed by Fred Reichheld and his colleagues at Bain & Company and Satmetrix, is based on asking customers a single question that is predictive of both repurchase and referral. It works by asking a single question, “On a scale of 0 to 10, how likely are you to recommend (insert your company name here) to a friend or colleague?” Now, as much as that can be an indicator of customer satisfaction, it can also be a telling question to ask of employees. The same principles apply, as employees are the single largest source of referrals for new hires, and referrals are a key indicator for longevity and productivity in your employees. Figure out what percentage of the employees surveyed give the company a 9 or 10, and label that your ratio of “promoters.” Calculate your ratio of detractors by figuring out the percentage of people surveyed who gave you a score of 0 to 6. Obviously the results need to be kept confidential if you’re doing the survey of employees, but the results are indicative of internal opportunities and work to be done. You calculate your Net Promoter Score (NPS) by subtracting your percentage of detractors from your percentage of promoters. The average company in the U.S. has a Net Promoter Score of between 10 and 15 percent while a good Net Promoter score is greater than 50 (Netflix, Amazon) and a world class Net Promoter Score is above 70 (Apple, Tesla, BMW). The glaring conclusion is that companies with an above-average Net Promoter Score grow faster than average-scoring businesses.

- Revenue per Employee (RPE)

Payroll is the number one expense for most businesses, which explains why maximizing your revenue per employee can translate quickly to the bottom line. It’s a multi-faceted indicator of employee quality, company culture, employee-customer relations and the overall health of the business.

“Revenue per employee (RPE) is one of the most underrated metrics available for assessing business performance in a crowded marketplace.” Many leaders look at gross income and overall market share, but neither metric provides much actionable data. “If a competitor is achieving far higher RPE numbers than you, then you’ve got a pretty clear signpost towards areas for improvement.”

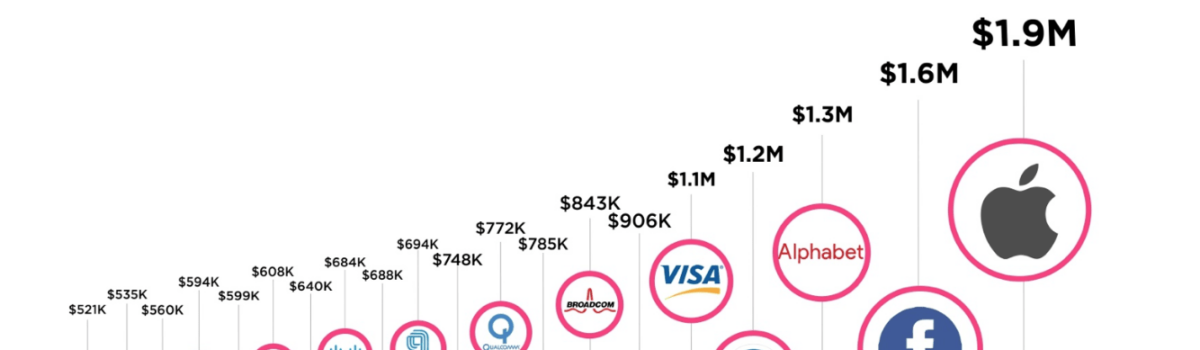

Amongst the largest corporations, average revenue per employee hovers at an astounding $1.3 million, with oil companies leading the way. Technology companies, where employee culture is considered some of the most innovative and efficient, put up some impressive RPE numbers as shown in the graphic above.

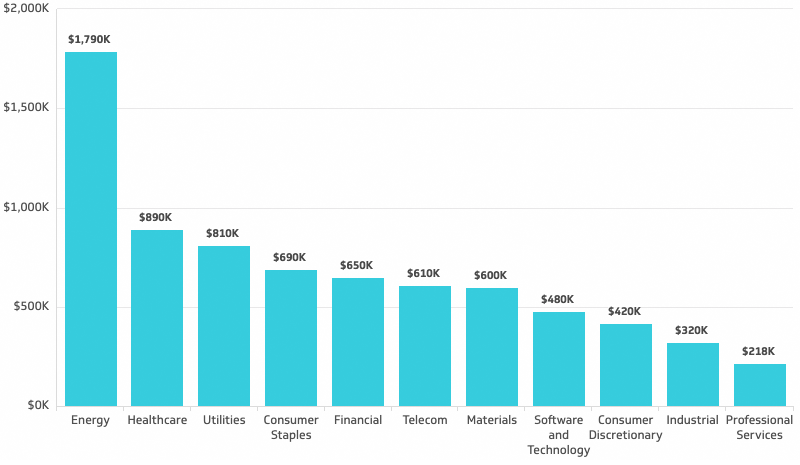

Some smaller companies struggle to cross the RPE threshold of $100,000, though their businesses are still wildly valuable (as size definitely does matter). Interestingly, smaller firms, which you would expect to be more productive than their larger competitors, actually average just over $100,000 per employee per year vs. almost $300,000 for the Fortune 500. All those systems and processes do count for something. Typical revenue per employee for various industries are shown below.

If you’re interested in benchmarking your industry, go to www.hoovers.com, the leading business database in the U.S. and search for larger companies in your industry. Click on the Fact Sheet that displays as an option and simply take revenues and divide by the number of employees.

Case Study – Revenue per Employee – The Container Store

An impressive case study can be made from the practices of The Container Store, the privately held retailer out of Texas, named one of the top places to work in the U.S. the past five years. They have a simple productivity formula: one great employee replaces three good employees; pay them twice as much ($20 per hour vs. the standard $10 a typical retailer pays) while having a lower total wage cost; and provide each employee with 160 hours of training. In essence, fewer higher paid smart people rather than a bunch of low paid “dump” folks! It’s your choice. And if you’re having a tough time recruiting employees, consider that The Container Store had 4000 people apply for the 40 positions they needed when they opened one of their retail stores in New York City. By building their business model from the very beginning to focus on garnering three times the productivity from sales associates, they can afford to pay them considerably above industry norm. The extensive training, in turn, helps to drive the productivity necessary to make the economics work. And the higher wages help to attract a better initial employee and retain the highly productive employees they create through their educational programs.

Now, it might seem logical to trim staff numbers to send your RPE ratios through the roof but don’t fall for it, as increasing workloads and lowering FTEs has been proven to negatively impact productivity in the long term.

The think tank at McKinsey has looked at RPE and at the intangible value that human capital contributes to businesses, and their results are thought-provoking:

“The vast majority of companies still gauge their performance using systems that measure internal financial results—systems based on metrics that don’t take sufficient notice of the real engines of wealth creation today: the knowledge, relationships, reputations, and other intangibles created by talented people and represented by investments in such activities as R&D, marketing, and training.

Companies fill their annual reports with information about how they use capital but fail to reflect sufficiently on their use of the “thinking-intensive” people who increasingly drive wealth creation in today’s digital economy.”

They go so far as to suggest a remedy for company CEOs and leadership that might be stuck in the past. “To boost the potential for wealth creation, strategically minded executives must embrace a radical idea: changing financial-performance metrics to focus on returns on talent rather than returns on capital alone. This shift in perspective would have far-reaching implications—for measuring performance, for evaluating executives, even for the way analysts measure corporate value. Only if executives begin to look at performance in this new way will they change internal measurements of performance and thus motivate managers to make better economic decisions, particularly about spending on intangibles.”

When it comes to building or presenting the value of your business, whether you’re looking to sell it or not, the data picture that you present truly does speak volumes. Like an artist using multiple textures and colors, data ratios, especially as they relate to employee efficiency metrics, can tell a much more compelling story than just looking at gross revenues or inventory turns.

If you’re still wondering if revenue per employee translates into bottom line performance, consider this: one recent study in the technology industry (software, hardware, IT services, etc.) found that the top 10% of companies ranked by performance had roughly twice the revenues per employee as the average. Now, can you afford not to examine RPE in your own business? Something to think about, hard.

At Executive Forums Silicon Valley, selected business owners and leaders work together to gain clarity, insight and accountability to ignite their leadership engines, grow their businesses and improve their lives. If you are interested in learning more about Business Owner Advisory Boards, Entrepreneurial Operating System (EOS), Stages of Growth, Value Builder System or becoming a member at Executive Forum Silicon Valley, please contact gperkins@executiveforums.com or call 408-901-0321. For more information visit http://www.execforumssv.com/ .