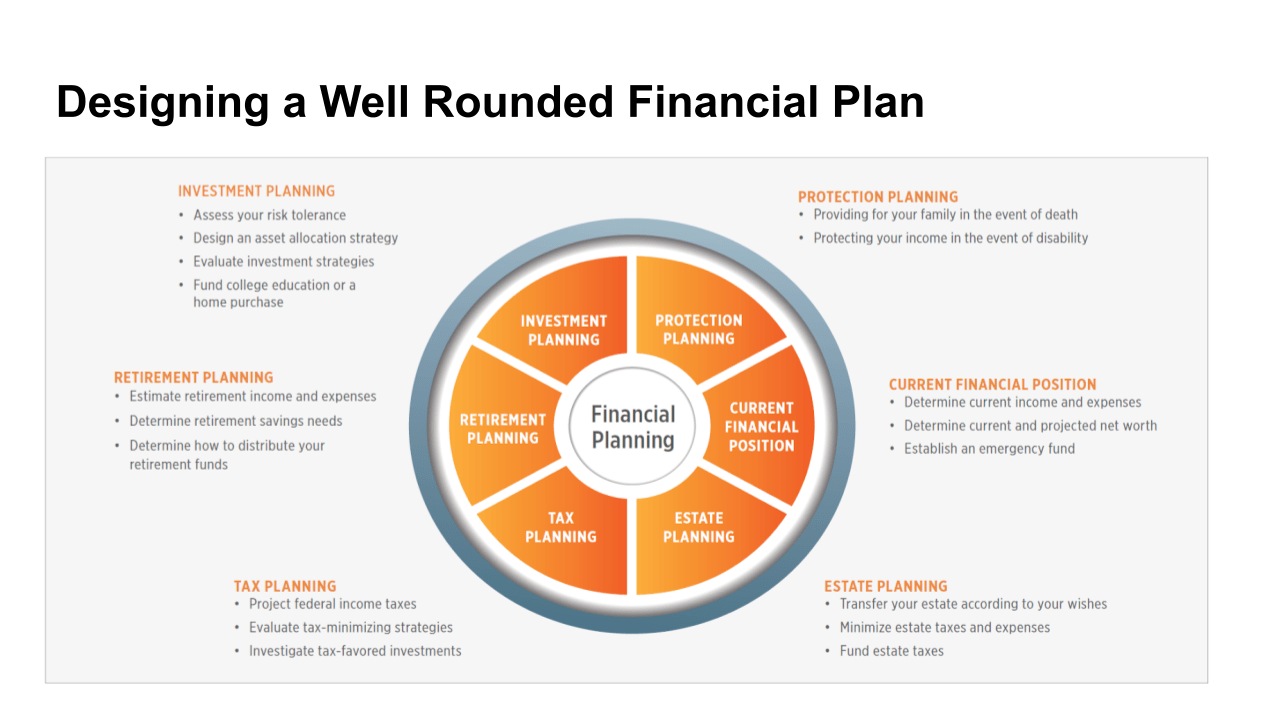

Financial planner and wealth advisor Stephen Grochol of SGC Financial Services presented at the Executive Forum Silicon Valley in 2021 about all major six areas of financial planning: Current financial position, retirement planning, insurance protection planning, investment planning, estate planning and tax planning.

To put all pieces together AND to accomplish one’s retirement goals, these steps need to be taken:

- Identifying goals

- Gathering data

- Analysis and planning

- Develop solutions

- Implement strategies

- Review (quarterly)

Current financial situation

“You don’t know where you are going if you don’t know where you are…” said Mr. Grochol. Whether an individual or a couple, the first place to start is a current year’s balance sheet that breaks down assets and liabilities, as well as percentage for asset types such as cash, taxable investments, qualified retirement, life insurance and real estate. This first step is to:

- Determine current income and expenses

- Determine current and projected net worth

- Establish an emergency fund

Retirement planning

To prepare for retirement, you need to

- Estimate retirement income and expenses

- Determine retirement savings needs

- Determine how to distribute your retirement funds

To determine if an individual or a couple have enough funds for retirement, projections will be made for possible retirement preferences such as

- When you can retire: early, late, or on time

- Spending levels during retirement

- Risk analysis for various market conditions

- Remaining assets for your estate

Insurance planning

The purpose of insurance planning is for

- Providing for your family in the event of death

- Protecting your income in the event of disability

For most of the aging retirees, long term care costs can be significant without adequate long term care insurance. In the event of disability, not only will there be substantial draining of wealth, but there is also the opportunity cost as the lost investment growth on the money used for paying for care from income or from existing investments. It is important to do the following planning long before retirement:

- Longer term care insurance planning

- Life insurance effect on protection planning and estate transfer

- Long term disability

- Health insurance

- Liability insurance

Investment planning

One important way of wealth accumulation is through investment, which requires one to

- Assess your risk tolerance

- Design an asset allocation strategy

- Evaluate investment strategies

- Fund college education or a home purchase

Asset allocation depends on each person’s risk tolerance. Mr. Grochol presented this question for members of the Executive Forum to determine their own risk tolerance:

Which of the following statements would best describe your reaction if the value of your portfolio were to suddenly decline by 15%?

- I would be very concerned because I can’t accept fluctuations in the value of my portfolio.

- If the amount of income I receive was unaffected, it wouldn’t bother me.

- Although I invest for long-term growth, even a temporary decline would concern me.

- Although I invest for long-term growth, I would accept temporary fluctuations due to market influences.

Estate Planning

The purpose of estate planning is to:

- Transfer your estate according to your wishes

- Minimize estate taxes and expenses

- Fund estate taxes

To avoid costly and prolonged probate, these documents need to be prepared in advance of one’s death:

- Trust

- Last Will and Testament

- Power of Attorney

- Health Care Directive

- Charitable Remainder Trust

Tax planning

- Project federal income taxes

- Evaluate tax-minimizing strategies

- Investigate tax-favored investments

With every financial decision and recommendation in a financial plan, tax planning needs to be strongly considered in all areas and at every phase.

Please email Stephen Grochol at stephen.grochol@sgc-financial.co, or call: (650) 227-0380

===============================================================

At Executive Forums Silicon Valley, selected business owners and leaders work together to gain clarity, insight and accountability to ignite their leadership engines, grow their businesses and improve their lives. If you are interested in learning more about Business Owner Advisory Boards, Entrepreneurial Operating System (EOS), Stages of Growth, Value Builder System or becoming a member at Executive Forum Silicon Valley, please contact Glenn Perkins gperkins@executiveforums.com or call 408-901-0321. For more information visit http://www.execforumssv.com/.